When to Consider the Tax Extension for Your 2019 Business Taxes If you ask for an extension, you will have until Novemto file your return, as the fifteenth falls on a Sunday in 2020. For your 2019 return, you’ll need to file your taxes or an extension by May 15, 2020. What Exempt Organizations (Nonprofits and Charities) Need to Do By Their Tax DeadlineĮxempt organization, such as a nonprofit or charity, file taxes on the fifteenth day of the fifth month of your fiscal year or the fifteenth day of the eleventh month if you file an extension. If you ask for an extension, you will file taxes by October 15, 2020, but you will still need to pay taxes by April 15. This means you will file your taxes or an extension on April 15, 2020, and pay any tax liability you owe. What Individuals and C Corps Need to Do By Their Tax DeadlineĪs an individual (including sole proprietors) or corporation, your taxes are due on the fifteenth day of the fourth month of your fiscal year or the fifteenth day of the tenth month if you file an extension. For this reason, if you plan on electing to extend your tax deadline, be sure and let all partners and shareholders know so they can do the same! So when your flow-through entity files a Form 1065 to the IRS, you must also issue Schedule K-1s to each partner or shareholder for them to report on their individual returns. As a flow-through, your business’s income and losses get passed on to the partners, owners, and shareholders. What Flow-Through Entities (S Corps or Partnerships) Need to Do By Their Tax DeadlineĮntities-like S Corps and Partnerships-get the name “flow-through” or “pass-through” because they do not pay income tax. Original tax deadline for exempt organizations ( Form 990)Įxtension tax deadline for exempt organizations ( Form 990) Original tax deadline for sole proprietors and individuals ( Form 1040)Įxtension tax deadline for sole proprietors and individuals ( Form 1040) Original tax deadline for C Corporations ( Form 1120)Įxtension tax deadline for C Corporations ( Form 1120) Original tax deadline for S Corporations ( Form 1120S)Įxtension tax deadline for S Corporations ( Form 1120S) Original tax deadline for partnerships ( Form 1065)Įxtension tax deadline for partnerships ( Form 1065) The table below covers when each type of business entity needs to file 2019 taxes in 2020 (using the calendar year):Ģ020 Tax Deadlines for Filing 2019 Business Returns

Using your entity type, you can identify what your deadline is for filing business taxes and what it would be if you elect to take advantage of the extension, but you’ll also need to take weekends and federal holidays into account. When are 2019 business taxes due in 2020?

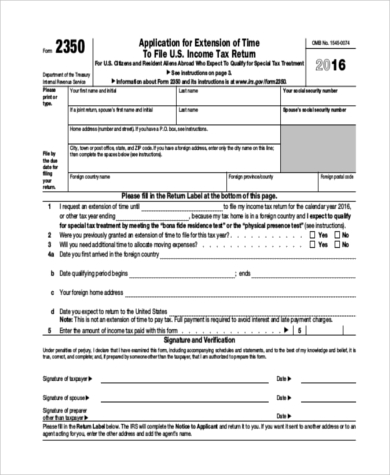

#2016 tax extension form corporations how to#

If your business uses another fiscal year, jump down to the bottom of this article to see how to adjust your tax calendar accordingly. Using an Alternative Fiscal Year? Don’t miss this:įor the purpose of this article, we’ve used the calendar year (January 1 through December 31). (Still working on your 2018 business taxes? Check out those dates in the 2018-2019 version of this calendar.) In the article we’ll focus on the latter to help all business owners build a 2019 business tax calendar to keep up with filing responsibilities and avoid late penalties. By outsourcing your business’s accounting and taxes with inDinero, your covered on both fronts. Getting your taxes filed on time is a lot easier when you a) have a year-round accounting system and b) have a clear deadline to aim for.

0 kommentar(er)

0 kommentar(er)